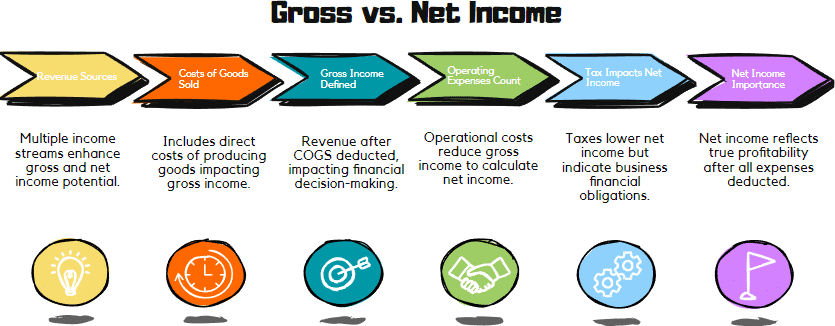

What is the Difference Between Gross and Net Income?

As a small business owner, you’re constantly juggling numbers. Two of the most important are gross income and net income. While they might sound similar, they represent vastly different aspects of your financial health.

We will examine the profit and loss accounts with examples and the difference between gross salary and net salary.

Gross vs Net Income

Gross income is your total revenue less the Cost of Goods Sold (COGS); it is the top line of your income statement before any other costs are deducted. Net income, on the other hand, is your profit – what’s left after all those expenses are paid. Understanding the crucial difference between these two figures is essential for accurate budgeting, strategic pricing, and, ultimately, the long-term success of your business.

Gross Income Definition

The gross income for a business is the gross revenue generated before any general expenses or deductions are subtracted. The initial figure represents the raw earnings from the company’s core business operations. Consider it the “top line” of your income statement, the first number you see when assessing your business’s financial performance. For many businesses, gross income is calculated by subtracting the cost of goods sold (COGS) from total revenue. This calculation, resulting in gross profit, clearly shows how efficiently the business generates revenue from its products or services.

Gross income encompasses all the money a business brings in from its primary activities. This includes sales revenue from products or services and any other income directly related to the business’s operations. Gross income serves as a crucial starting point for understanding a business’s financial health, as it provides a snapshot of the company’s ability to generate revenue. By focusing on gross income, business owners can assess the effectiveness of their sales strategies and pricing policies and identify areas for potential improvement in their core operations.

What is Net Income

Net income represents a business’s final profit after all expenses are subtracted from total revenue. It’s the amount of money left after accounting for the cost of goods sold, operating expenses, interest, and taxes. Essentially, net income is the company’s “bottom line,” indicating its true profitability. Calculating net income involves taking gross income and deducting all business-related expenses.

These expenses include operating costs such as rent, utilities, general business expenses and salaries, which are subtracted to arrive at net income. Interest expenses, the costs of borrowing money, are also factored into the calculation. Finally, taxes are deducted, leaving the final net income figure. Net income is a critical metric for assessing a business’s financial health and profitability. Investors and creditors rely on net income to evaluate a company’s performance, and business owners use it to make informed decisions about investments and growth.

What is the difference between Gross and Net Income Examples?

Below, we look at examples of Gross and Net Income.

Gross Income Example

Imagine ABC Computers, a small business that sells computers and provides IT consultancy. In a given month, the business generated the following:

- Computer Sales: 15,000

- IT Consultancy Fees: 5,000

To calculate the gross revenue or sales, we add these two revenue streams:

- 15,000 (Computer Sales) + 5,000 (Consultancy Fees) = 20,000

Therefore, the revenue for that month is 20,000. This figure represents the total revenue earned before any expenses, such as purchasing the computers or any operational costs, are deducted.

Now, let us imagine that the cost of the computers sold was 8,000. In this case, the gross profit would be calculated as:

- 20,000 (Computer Sales) – 8,000 (Cost of Computers) = 12,000 Gross Income

This 12,000 figure is the gross profit that can be used to pay for overheads and other business expenses.

Net Income Example?

Let’s continue with the ABC Computer example above and calculate the net income. To do this, we need to introduce some operating expenses:

ABC Computers Expenses (Monthly):

- Rent: 1,000

- Utilities: 300

- Salaries 4,000

- Marketing/Advertising: 200

- Office Supplies: 100

- Taxes: 500

Recap of Gross Profit:

As previously calculated, the Gross profit was 12,000.

Calculating Net Income:

Now, we subtract the total expenses from the gross profit:

Total Expenses: 1,000 + 300 + 4,000 + 200 + 100 + 500 = 6,100

Net Income: 12,000 (Gross Profit) – 6,100 (Total Expenses) = 5,900

Therefore, ABC Computers’ net income is 5,900 actual profit after all expenses were paid.

Key points to remember:

- Net income is what’s left after all the bills are paid.

- It’s the figure that truly reflects the business’s financial health.

- This money can then be reinvested back into the company, or taken as profit by the owner.

It is essential to look at both figures as a business may have a high turnover and think it is performing well. Calculating the net income, including the expenses, may produce a different picture. An example is a business with an annual gross income of 250,000 that thinks it is doing well. When looking at the profit and loss account, there are expenses of 260,000, so the business has made a loss.

Using the same business, here is an example annual Income Statement:

| Profit and Loss account of ABC Computers For the period 1st April – 31st March | ||

|---|---|---|

| Turnover | 300,000 | |

| Cost of Sales | 50,000 | |

| Gross Profit | 250,000 | |

| Rent | 87,000 | |

| Wages | 140,000 | |

| Office Expenses | 25,000 | |

| Depreciation | 2,000 | |

| Insurance | 2,500 | |

| Software | 3,500 | |

| Total Overheads | 260,000 | |

| Net Profit | -10,000 |

In the example, the business would need to examine the figures and see if it can make any savings. It would also need to compare this profit and loss to the previous years to see the differences. It might be that turnover has dropped while other expenses have stayed the same, or expenses have increased.

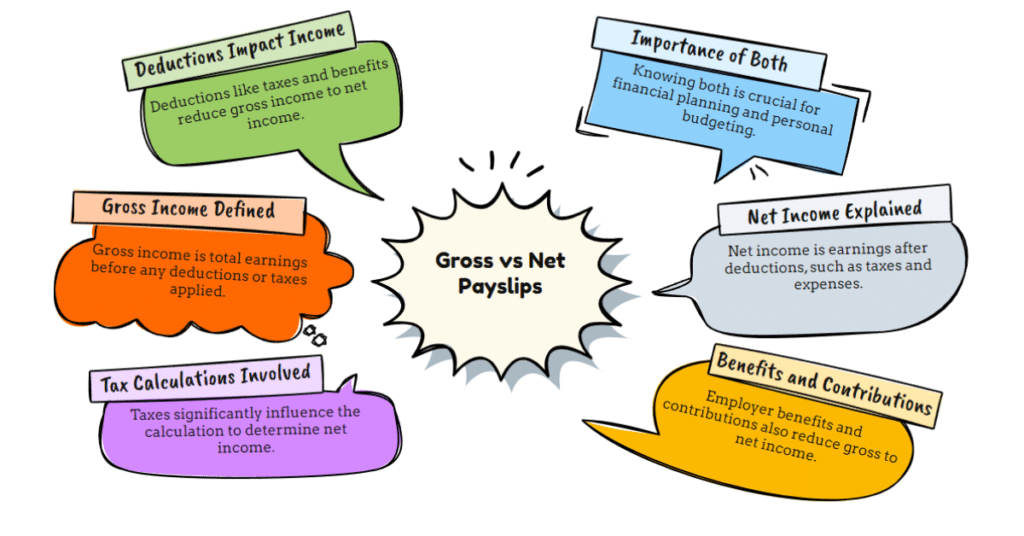

Gross vs Net Income Wage Slips Explained

The difference between gross and net income is also essential for employees looking at their payslips. Each employee earns a gross pay or taxable income, but deductions are required for income tax, NI, Student loans and pensions. The figure that the employee receives is the net income.

Example Wages

An employee has an annual salary of £24,000; this is the taxable income. The monthly payslip may have the following:

| Gross Income | 2,000.00 |

| Pension Deductions | 100.00 |

| Taxable Income (includes personal allowance) | 852.50 |

| Tax | 170.50 |

| National Insurance | 76.20 |

| Net Pay (take home) | 1653.30 |

The taxable income is Gross income minus pension minus personal allowance (12,750). From the taxable income, you then deduct income tax and national insurance. Your tax will depend on your salary, personal allowance and any other deductions.

To estimate your take-home pay, use a salary calculator. Entering your gross income will give you a good indication of deductions and net income.

P60s

A P60 is an annual statement employers provide to employees, summarising their pay and deductions for the tax year (April 6th to April 5th). It details the total gross income, the amount of income tax and National Insurance contributions deducted, and any other relevant financial information. The P60 also helps individuals verify that their tax deductions are accurate and provides a comprehensive overview of their annual earnings, making it an essential component of personal financial records.

Conclusion To Gross Income and Net Income

Gross income is the total money you make, and net income is what is left after expenses or deductions. For businesses, that means revenue versus profit/loss. For individuals, it’s the difference between your total pay and take-home pay on your payslip. Knowing the difference helps you understand your financial situation, whether you’re looking at a business’s bottom line or pay.

Return from the difference between Gross and Net Profit to Profit and Loss Statement.