Loan Amortisation Schedule

Introduction and Importance in Financial Planning

Loan amortisation is a crucial concept in financial planning, as it helps individuals and businesses understand and manage their loan repayment process. In this introduction, we will cover the basics of loan amortisation, what a loan amortisation schedule is, how it works, and why it is essential for effective financial planning.

Table of Contents

What is Amortisation?

Amortisation is paying off a loan or debt through regular, fixed payments over a specific period. These payments typically include principal and interest components, ensuring that the loan balance is gradually reduced until it reaches zero at the end of the term.

Loan Accounting

If you are a business, it is important to learn about accounting for loans. Read our guide, which includes examples and journal entries.

What is a Loan Amortisation Schedule?

A loan amortisation schedule is a detailed table that outlines the periodic payments made on a loan over time. It clearly shows the allocation of each payment towards the principal amount and interest, along with the remaining balance after each payment. This schedule enables borrowers to visualise the progression of their loan repayment and understand how much they still owe at any given point during the loan term.

How Does a Loan Amortisation Schedule Work?

When you take out a loan, the lender calculates the monthly payment required to repay the loan within the specified term. This calculation considers the principal amount, interest rate, and loan duration. The loan amortisation schedule then breaks down each payment to show the portion allocated to interest and applied to the principal loan.

At the beginning of the loan term, the interest component is typically higher, while the principal part is lower. As the loan progresses, the interest portion decreases, and the principal portion increases. This shift occurs because the interest is calculated based on the outstanding principal balance, which reduces with each payment.

Free Loan Amortisation Schedule Excel

Although we have produced our amortisation schedule for free download below, if you wish to create your own, here are the steps

- Determine the loan’s principal amount, interest rate, and term.

- Calculate the fixed monthly payment using an amortisation formula or an online calculator.

- For each payment period, calculate the interest portion by multiplying the outstanding principal balance by the periodic interest rate.

- Subtract the interest portion from the total monthly payment to determine the principal amount.

- Update the outstanding principal balance by subtracting the principal portion of the payment.

- Repeat steps 3-5 for each payment period until the loan is paid off.

Our free loan or mortgage amortisation takes the headache out of the calculation.

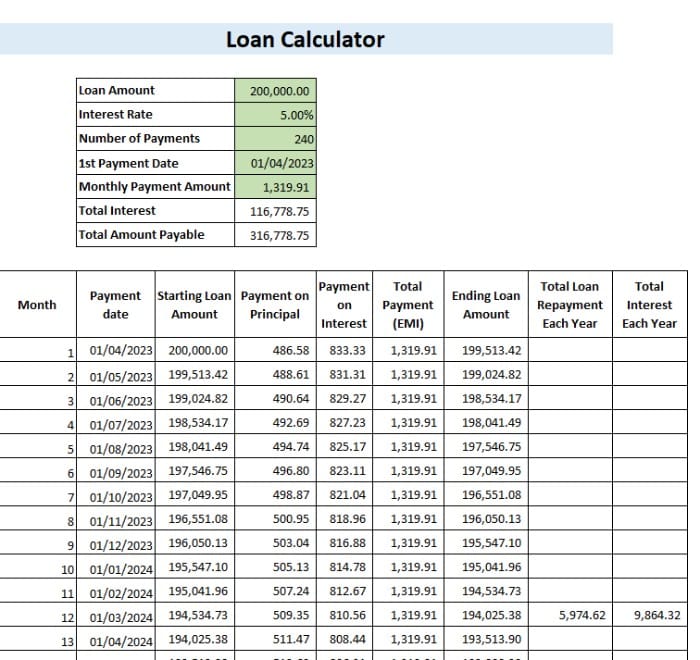

Instructions for use

Download the free amortisation schedule Excel below. We have posted an example to help when you open the Excel spreadsheet. For your loan, complete the following cells in green:

Loan Amount – This is the amount you borrow from the bank or other financial institution.

Annual Interest Rate – When you take out a loan, you will be given a fixed interest rate, shown as a percentage.

Number of Payments – If you have been quoted in years, multiply the number by 12 to give the total months you will repay the loan.

1st Payment Date – By entering the first payment date, all the payment dates will be entered.

Monthly payments – the amount paid each month will include both the principal loan and the interest.

Once these figures are entered, the remaining balance, total interest and total amount payable are calculated. It will also show the annual interest and principal loan paid.

Example of a Mortgage Amortisation Schedule Excel

Licence Agreement

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

Why is a Loan Amortisation Schedule Important in Financial Planning?

A loan amortisation schedule plays a critical role in financial planning for several reasons:

- Budgeting and Cash Flow Management: By understanding the breakdown of principal and interest payments, borrowers can effectively budget for their monthly loan payments and manage their cash flow.

- Interest Savings: A loan amortisation schedule allows borrowers to see how much interest they will pay over the loan term. This insight can help them explore options to reduce interest costs, such as making additional principal payments or refinancing the loan at a lower interest rate.

- Loan Progress Tracking: The schedule enables borrowers to track their progress in paying off the loan and understand how close they are to being debt-free.

- Informed Decision-Making: A clear understanding of the loan repayment process helps borrowers decide whether to take on additional debt or prioritise other financial goals.

Alternative to Amortisation Schedule for Additional Payments

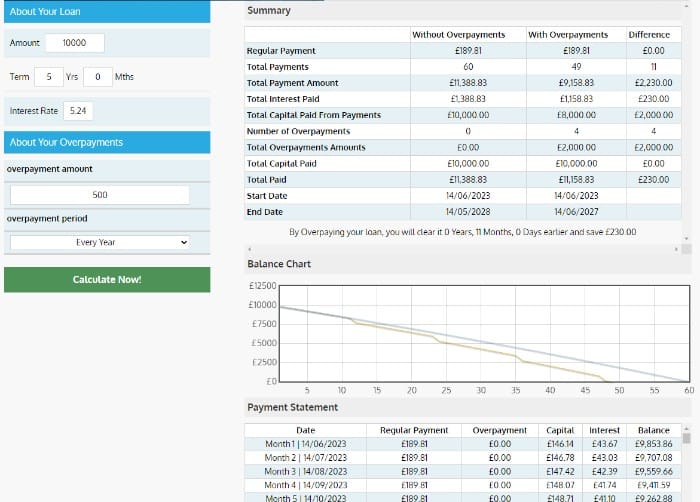

If you want to make extra payments on the loan, you can use the ‘Loan Overpayment Calculator’ to calculate how much money you will save by making additional payments.

This is a great way to ensure your loan balance reduces quicker than usual without changing the loan repayment period. There are lots of calculators available; we suggest checking out The Money Calculator. It allows you to set a loan overpayment by week, month or year and will show how the additional payment affects the loan.

The image below shows an example of their amortisation schedule calculator, with a breakdown of the principal payment and interest payment per month.

When making overpayments to reduce the time you pay, ensure that the monthly mortgage payments stay the same and the amount is reduced from the loan.

Free Amortisation Schedule Conclusion

In conclusion, a loan amortisation schedule calculator is essential for managing loans and maintaining healthy financial planning. It provides valuable insights into the repayment process, allowing borrowers to make informed decisions and effectively manage their debt.