Self Employed and Need Help Dealing with Tax?

From understanding your obligations to staying compliant, tax is one of the most dreaded parts of being self-employed. With January on the horizon, it won’t be long before it’s time to file online tax returns.

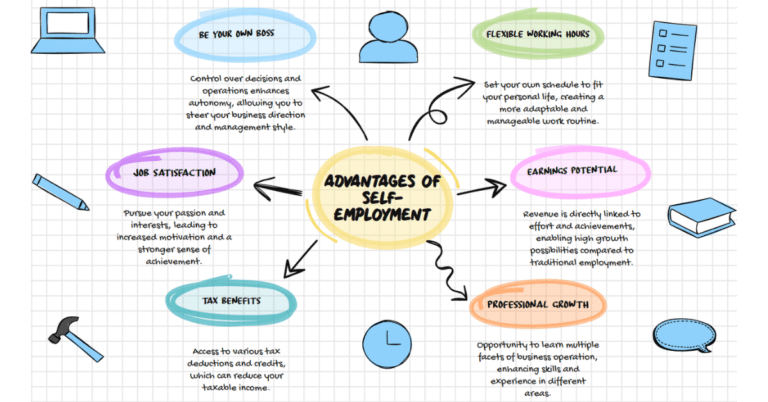

The good news is that if you’re self-employed, you will continue to benefit from lower NICs.

Since April 2024, you will no longer have been required to pay Class 2 National Insurance.

Whether you’re a sole trader or own a business, Business Accounting Basics wants to make the process easier. Our solutions include a Tax Calculator that is quick and easy to use. We also offer a range of other tools to help you stay on top of your tax.

Key Deadlines for the Tax Year

The UK tax year runs from 6 April to 5 April the following year. Dates to write on your calendar include:

- 5 October. This is the time to register for self-assessment if you’re new to filing.

- 31 October. You must submit paper tax returns for the previous tax year.

- 31 January. You should have filed online tax returns and paid any tax owed for the previous tax year.

Failing to meet these deadlines can result in unwanted penalties. For instance, a late filing can lead to an initial £100 penalty.

Why Self-Assessment Can Be Complex

Even a small mistake in your tax return can lead to paying too much tax or penalties. One of the most common issues is keeping accurate records of income and expenses. Business Accounting Basics make this process much easier with expert advice on bookkeeping. We regularly support small businesses who do their own bookkeeping or use accounting services.

Ultimately, we can make the process much less stressful and time consuming. If you’re self employed, the last thing you want is to be worrying about tax over Christmas.

Why Choose Us to Help with Self-Assessment?

We provide many resources for individuals and businesses navigating the complexities of tax and self-assessment. Our advice comes from a team with a deep understanding of HMRC requirements.

Business Accounting Basics stays up-to-date with changes in tax law, ensuring our tools are useful and convenient.

Advice Tailored to your Needs

At Business Accounting Basics, we recognise that every individual and business is unique. We take the time to get to know your circumstances.

Save Time this Season

Filing your self-assessment tax return can take hours. It’s especially time consuming if you’re

unfamiliar with HMRC’s processes.

With our helpful tools, you can save valuable time and focus on what matters most—whether that’s growing your business or enjoying time with family and friends.

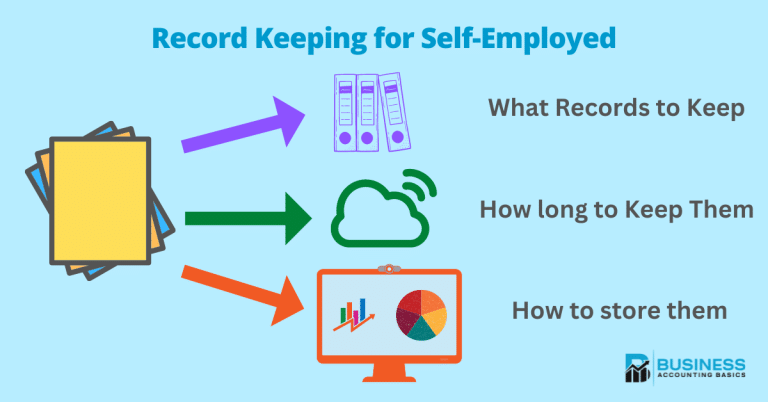

Accurate Record-Keeping

Quality record-keeping is essential for filing accurate returns and defending against potential HMRC audits. With our expert advice and tools, you can reduce the risk of errors and have everything you need for a smooth filing process.

Reduce Stress During the Process

Navigating tax laws can be daunting. It’s particularly pressurised if you worry about penalties or audits looming. Our advice can make the self-assessment process easier, ensuring you feel confident in the process.

Make the Most of our Digital Tools and Support

We offer the latest accounting software to streamline your self-assessment process. Our team is always happy to provide information on the latest tax changes which affect your circumstances, whether you run a small business or work freelance.

Why Accuracy Matters in Self-Assessment

Accuracy is crucial when filing a self-assessment tax return. Mistakes can lead to:

- Overpayment: Missing out on deductions or allowances.

- Underpayment: Leading to penalties and interest charges.

- Scrutiny from the HMRC: Triggering audits or investigations.

By choosing Business Accounting Basics, you will have excellent resources to make tax less ‘taxing’. All our resources are free, easy to understand and practical. They’re created by a team with years of experience and with over 350,000 templates available, it’s easier to simplify the accounting process.

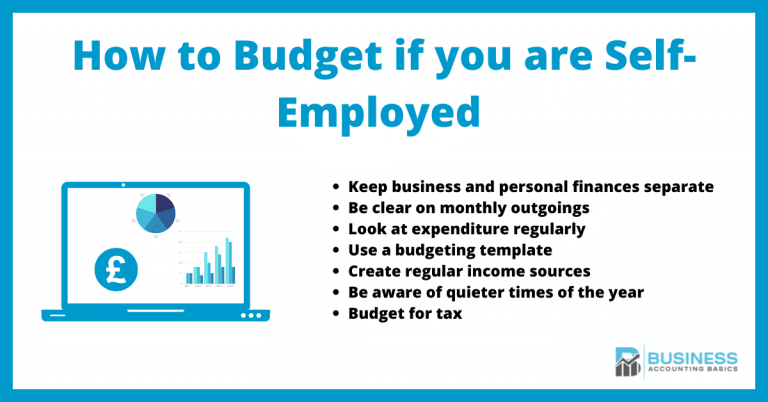

We offer plenty of advice for self-employed individuals and freelancers. For instance, it helps to separate personal and business accounts to avoid confusion. Invoicing regularly can help you maintain your cash flow, and means you can keep records of income and expenses.

Additional Support from Business Accounting Basics

Beyond self-assessment, we offer advice on many different topics, including:

- Bookkeeping: Keeping your financial records organised and up-to-date.

- VAT Returns: Managing your Value Added Tax obligations.

- Payroll Services: Ensuring your staff are paid accurately and on time.

- Business Advice: Providing strategic insights to help your business grow.

Whether you’re filing your first return or dealing with a complicated tax situation, our website can prove to be invaluable. Choose us to advise on your self-assessment journey and you can proceed with ease and confidence. We have a comprehensive guide for anyone self-employed, including free bookkeeping templates.